Real-time balance verification

Real-time balance available in financial accounts is leveraged across the fintech landscape, from fraud detection to loan underwriting and everything in between.

Code snippet

Steps

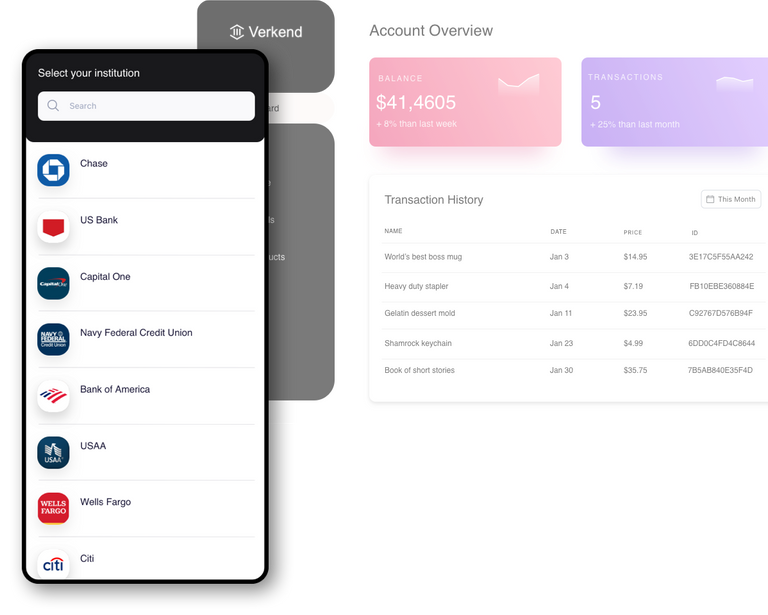

Institutions

Possibilities

Checks and balances

When writing checks or making payments from financial accounts, real-time balance information helps to guard against overdraft fees and assess transactional risk. According to a recent study, 27% of payment declines were due to insufficient funds. Verkend's realtime balance data allows companies to check the available funds before a transaction is initiated to prevent these declines from happening, avoiding NSF fees and enhancing the consumer experience.

Many of our customers also use the real-time balance API as part of their risk assessments for transaction limits and loan underwriting. Traditionally, this involved a manual process of submitting financial documents with a turnaround time measured in days and weeks. With this information now available in realtime, risk officers and underwriters can approve transactions in seconds.

Data +

Security

Reach out to our sales team to get your questions answered and learn more about how we can improve your financial services offerings